Our commitment

We focus on renewable energies, in particular wind and solar PV assets, as central pillars of a climate- friendly and sustainable future. We are committed to ecological values that reflect our vision as a reliable, successful and responsible energy producer, trustee and employer. We integrate technological advances and innovative research approaches to incorporate fauna, flora and wildlife into our projects in an environmentally responsible way. Local communities benefit through a strengthened economy and cheaper green electricity. With state-of-the-art technology, new research and the highest quality standards, we create sustainable value and secure an attractive return for our investors.

Our track record

-

SDG 9 – Industry, innovation and infrastructure

Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation.13.491.465

MWh renewable electricity -

SDG 11 – Sustainable cities and communities

Make cities and communities inclusive, safe resilient and sustainable.5.396.586

households served -

SDG 13 – Climate action

Take urgent action to combat climate change and its impacts.8.769.453

tonnes C02e avoided -

SDG 3 – Good health and well-being

Ensure healthy lives and promote well-being for all at all ages.156.037

cases of disease avoided -

SDG 7 – Affordable and clean energy

Ensure access to affordable, reliable, sustainable and timely energy for all.2.039.265,21

kWp rated capacity -

SDG 8 – Decent work and economic growth

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all.102

EE projects

As of 06/2024

You are currently viewing a placeholder content from Vimeo. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationOur local commitment

Sustainability-Related diclosures

The following disclosures relate to CEE Kapitalverwaltungsgesellschaft mbH in its role as a financial market participant pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosure requirements in the financial services sector (“EU Disclosure Regulation”).

Background

The EU published the so-called EU Disclosure Regulation on 27 November 2019. The objective of this Regulation is, in particular, to reduce information asymmetries in the relationships between clients and agents with regard to the inclusion of sustainability risks, the consideration of adverse sustainability impacts, the promotion of environmental or social features and, in regard to sustainable investments, by obliging financial market participants and financial advisors to provide pre-contractual information and ongoing disclosures to end-investors when acting as agents on behalf of those end-investors (clients). This is mainly done against the background that the transition to a low-carbon, more sustainable, resource-efficient circular economy in line with the Sustainable Development Goals is considered one of the key issues for ensuring the long-term competitiveness of the Union’s economy. This is in line with the Paris Agreement concluded under the United Nations Framework Convention on Climate Change (“Paris Agreement”), which was approved by the Union on 5 October 2016 and entered into force on 4 November 2016. The Paris Agreement aims to act more decisively against climate change by, among other things, aligning financial flows with a pathway towards low greenhouse gas emissions and climate resilience.

Invest in a sustainable and future-oriented manner – that is our claim. By investing in the development and generation of renewable energies, we not only achieve attractive returns for our investors, but also sustainably secure our future. Our goal is to accompany and shape the expansion of the market for renewable energies in the long term.

As an investment manager and operator of long-term renewable energy projects, we are committed to achieving risk-adequate returns that are in line with our investors’ objectives. We are convinced that the integration of ESG criteria has a real, positive impact on our environment as well as our business environment and thus on our actions.

CEE Kapitalverwaltungsgesellschaft mbH also takes into account corresponding sustainability risks as part of its investment decision-making processes, i.e. such events or conditions in the environmental, social or corporate governance areas that could have a significant negative impact on the value of an investment if they were to occur.

The review of sustainability risks is based on the respective investment strategy of the mandates as well as the type of assets to be acquired and is carried out on the basis of qualitative and/or quantitative factors. The results – as part of the risk assessment – together with the results of the other due diligence checks (including legal, technical and commercial) are included in the overall assessment of the project. Our asset managers accompany the projects right from the start of the due diligence process. This ensures a seamless transition from the acquisition to the operational running of the projects and thus also the direct integration into the operational risk processes.

The corresponding requirements are documented within the framework of the internal ESG, risk and asset management guidelines as well as further process descriptions.

In addition, the company has internal guidelines and requirements (in particular anti-corruption guidelines, code of conduct and ethics and employee remuneration guidelines) to take sustainability factors into account in our actions and activities as a financial market participant.

Within the scope of investment decisions and the underlying due diligence processes, significant adverse implications for sustainability factors are taken into account. A sustainable risk is an event or condition in the environmental, social or corporate governance area whose occurrence could have a significant negative impact on the value of the investment. Sustainability risks can therefore lead to a significant decline in the financial profile, liquidity, profitability or reputation of the underlying investment. If sustainability risks are not already taken into account in the investment valuation process, they may have a material negative impact on the expected/estimated market price and/or liquidity of the investment and thus on the fund’s return. Sustainability risks can have a significant impact on all known risk types and contribute as a factor to the materiality of these risk types.

When making investment decisions, the assets are valued on the basis of the applicable investment conditions of the AIF in conjunction with the applicable requirements of the risk management strategy and the company’s investment and ESG strategy. This also includes the consideration of ESG risks, which are assessed as part of the project-specific reviews. In the case of ESG risks, the company assesses those risks that are considered material for the renewable energies asset class, in this case plants for the generation and storage of electricity from wind and solar energy. The ESG risks are evaluated and taken into account in the overall risk assessment with regard to their severity.

In this context, the assessment includes qualitative and quantitative assessment criteria relating to the areas of energy, water and wastewater management, the handling of residual materials, potential climate risks and risk factors in the areas of ecology, human rights, occupational safety and corporate governance.

For the relevant disclosures at product level in accordance with Article 7 of the EU Disclosure Regulation on the main adverse sustainability impacts, please refer to the product-specific disclosures of the respective funds in accordance with the EU Disclosure Regulation.

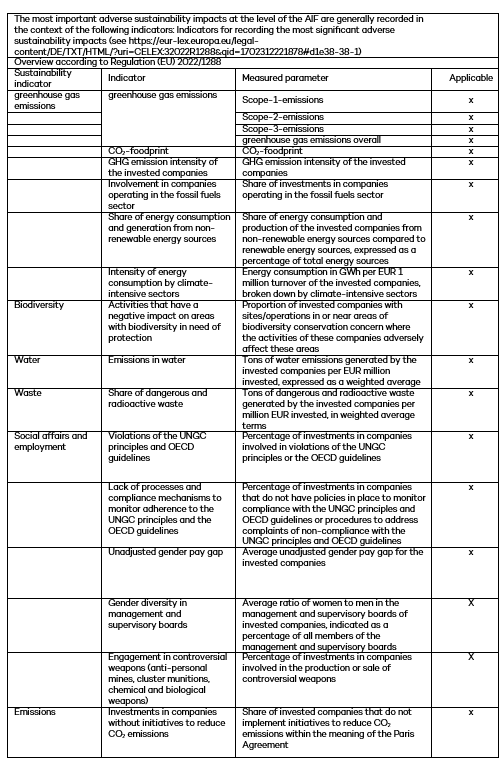

The main adverse sustainability impacts at the level of the AIF are generally recorded as part of the recording of the following indicators:

If individual indicators are not applied at AIF level or additional indicators are used, this is explained to investors in the relevant fund-specific documents.

The AIF mandates of the AIFM invest in renewable energies, in this case solar and wind power plants in Europe and the associated infrastructure including energy storage, thereby making an important contribution to climate protection. We are therefore actively supporting the achievement of the 2030 energy transition and the implementation of the Paris Climate Agreement. The investments therefore make a fundamentally positive contribution to a sustainable economy. Incorporating ESG criteria into our processes helps us and our investors to create social and economic value over the term of our investments and to mitigate the reputational, financial and operational risks that would otherwise result from poor environmental, social and corporate governance practices.

With regard to the main adverse sustainability impacts, the KVG has implemented the following measures.

Greenhouse gas emissions

The AIFM determines the expected greenhouse gas emissions for the individual investments, which in the case of investments in renewable energies, in this case solar and wind power plants in Europe as well as the associated infrastructure including energy storage, primarily result from the construction of the plants. The construction and operation of the plants makes a significant contribution to the transition to low-greenhouse gas electricity production, i.e. renewable energy sources (here: electricity from wind and solar energy) are used instead of fossil energy sources. By using renewable energies, a net avoidance of greenhouse gas emissions is achieved. In this respect, the investments aim to reduce the greenhouse gas emissions of the European energy industry as a whole. In addition, care is taken at investment level to ensure that, as far as possible, the investments themselves obtain their own energy requirements exclusively from renewable energies.

The mandates managed by the AIFM do not currently invest in any other asset classes.

Biodiversity

Within the scope of the investments, the necessary environmental impact assessments are carried out at the respective asset location in accordance with the applicable regional and national standards. This also includes the implementation of any compensatory measures, i.e. measures that reduce any adverse effects or achieve compensation elsewhere.

Water

Within the scope of the investments, the required assessments are performed with regard to environmental compatibility at the respective asset location and in compliance with the technical specifications for proper operation of the assets in accordance with the applicable regional and national standards. The technical maintenance concepts of the facilities and occupational safety requirements for the service providers are also designed to prevent the release of harmful and potentially water-polluting substances or, in the event of such substances being released, to prevent, contain or reduce their entry into the ground and soil – and thus, if necessary, into surrounding bodies of water or groundwater.

Waste

As part of the investment, during construction, operation and demolition/recycling, the required assessments with regard to waste management at the respective asset location and with regard to compliance with the (technical) requirements for the proper handling of hazardous waste are carried out and taken into account in accordance with the applicable regional and national standards. The technical maintenance concepts of the facilities and occupational safety requirements in relation to the service providers are also taken into account in order to ensure proper waste management and to avoid, contain or reduce any significant negative impacts. Furthermore, when making investments, we ensure that appropriate waste management regulations are included in the contracts wherever possible.

Social affairs and employment

As part of the investments and the ongoing management of the mandates, appropriate screenings are carried out via suitable data providers to identify relevant violations of the corresponding standards of the UN Global Compact and the OECD guidelines with regard to multinational companies. When investing in renewable energies, priority is also given to acquiring companies that do not have their own employees, in particular assets for generating electricity from wind and solar energy. The AIFM and their parent and sister companies themselves have company-wide standards and regulations in place to ensure compliance with the aforementioned frameworks, standards and principles.

Information pursuant to Art. 7 of Regulation (EU) 2019/2088 in relation to the financial products managed by the company is provided in the pre-contractual information. The timing and scope of the respective disclosures depend on the respective product category and classification in relation to Regulation (EU) 2019/2088.

The company is subject to the regulatory requirements applicable to capital management companies with regard to the design of its remuneration system. The documentation takes place within the framework of a corresponding remuneration guideline. The supervisory board of the company is responsible for the adoption and maintenance of the remuneration policy and oversees its implementation by the executive board.

In doing so, the remuneration policy is designed not to encourage disproportionate risk-taking – especially in comparison to the investment policy of a mandate.

The remuneration includes both fixed and variable components. In the determination of variable remuneration components, the achievement of sustainable business development, the protection of society as well as the protection of the mandates managed and investors, also in relation to relevant ESG factors, are also taken into account in the assessment when determining target achievement as part of the personal performance assessment.

Information in accordance with Article 6 of Regulation (EU) 2019/2088 in relation to the financial products managed by the company is provided in the pre-contractual information. The timing and scope of the respective disclosures depend on the respective product category and classification in relation to Regulation (EU) 2019/2088.

Article 3

|

Date

|

Amendment

|

|

April 2022

|

First publication

|

Article 4

|

Date

|

Amendment

|

|

April 2022

|

First publication

|

|

December 2023

|

|

Article 5

|

Date

|

Amendment

|

|

April 2022

|

First publication

|