Asset-class renewable energies

Attractive for investors and society.

Due to their positive characteristics with regard to long-term and calculable returns, alternative investments have become an indispensable portfolio component for institutional investors in recent years. Insurance companies, pension funds and pension schemes in particular, but also wealthy private individuals, see real assets such as real estate, private equity, infrastructure and renewable energies as an ideal complement to traditional investments, such as shares and bonds.

The particular attractiveness of renewable energies is due to high returns and the fact that they are largely independent of changes in the financial markets. Modern, ecologically developed societies are increasingly demanding sustainable and responsible investment along ESG criteria in a clean and stable energy supply. Investors can, therefore, actively help to shape climate protection and also benefit from the stability of renewable energies.

Because: The revenue base of the assets – electricity from wind and solar energy, i.e. from natural resources – is freely and gratuitously available, the quality of wind and solar energy is constant and, moreover, does not follow market cycles.

Long-term investments with stable value

Particularly in times of volatile capital markets and the expansive monetary policies of central banks, renewable energy assets play an important role as long-term investments with stable value: Tariff systems over a period of up to 20 years or long-term purchase agreements provide a stable planning basis and an attractive risk-return profile. Renewable energies are, therefore, not only a rapidly growing segment in the field of alternative investments but also make an important contribution to the diversification and optimisation of the risk-return structure of institutional investment portfolios within the framework of professional investment strategies.

Renewable energies in figures

The realisation of the energy transition and the creation of a sustainable energy supply is one of the central political and social issues worldwide. The global climate protection targets require enormous efforts to achieve the energy transition within the next few decades. According to the EU Commission, additional annual investments of €260 billion are needed to achieve the European climate targets alone.

The expansion of renewable energies is, therefore, one of the central building blocks of European climate and energy policy. By 2030, the EU Commission wants to increase the share of renewable energies in gross total energy consumption to 27 per cent.

https://www.bee-ev.de/unsere-positionen/europa

Turning point in the EU electricity market: Renewable energies overtake fossil fuels for the first time

In the first half of 2020, the share of renewable energies in the European electricity market was greater than that of fossil energy sources for the first time.

Investment focus on wind and solar farms

Active climate protection also offers attractive investment opportunities. Wind and solar power in particular are among the most mature and established asset classes. Both segments are characterised by significant technical developments in recent years. Also due to the EU-wide state subsidies of the last decades and the creation of clear and strict legal framework conditions, these assets represent a safe and reliable source of energy and income. Due to long-term remuneration models – whether through state feed-in tariffs or long-term purchase agreements – these asset classes are an important component of modern investment portfolios, especially in an uncertain and changeable market environment. At the same time, the high level of technical maturity of the assets offers significant potential for the continued operation of the assets beyond their original lifetime planning.

Another option in this context is so-called re-powering, i.e. replacing existing components with more powerful or efficient ones. A combination of wind and solar assets at portfolio level also results in significant positive diversification effects to stabilise the income streams of a renewable energy portfolio and limit fluctuations in value.

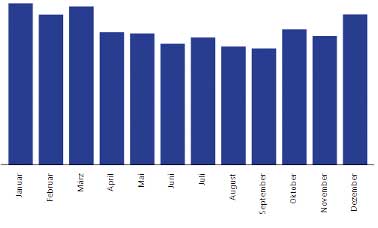

The CEE Group portfolio is characterised by this complementarity between solar and wind power. A large wind resource is available in the winter months when there is little sunshine, and the reverse is true in the summer months. Plan deviations between wind and solar can, therefore, largely balance each other out, which leads to a stable performance of the portfolio that has been proven for years.

Wind energy

Combined

Solar energy

Solar farms

As one of the fastest-growing renewable energy technologies, utility-scale solar offers diverse and scalable applications.

891 MWp installed capacity

47 established solar energy farms

Wind farms

Our growing wind portfolio is diversified across attractive energy markets in Europe: in Germany, France and Sweden.

636 MWp installed capacity

45 established wind farms